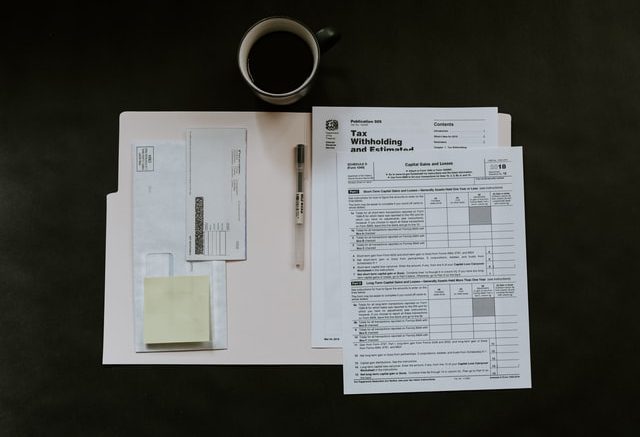

It’s tax time once again and there are many tax deductions for truckers out there to take advantage of. These tax tips are for any truck driver, including company and owner-operator, to help save them money.

Things like cell phones and licensing fees can be deducted from your declared taxable income. It pays to know the rules when it comes to what is and isn’t taxable, it’s also smart to keep all of your records for at least the last 3 years if not longer. Other things that can be deducted include internet usage, medical exams, truck repair and upkeep, food that is eaten while on the road, flashlights, food storage, and much much more. There are even states out there offering tax incentives to companies that hire and train new truckers to help fill the gaps of the trucker shortage currently going on. Click the link below to learn more about being a prepared trucker when it comes to this tax season.